A Few Things to Be Grateful For: 12.02.22

Updates for 12.02.22

eQuipt for New Accounts

This week’s update includes the following:

- Tax ID is no longer required when opening NFS Retirement and Transfer on Death accounts for Person or Trust Beneficiaries.

- 1st Party or 3rd Party must be selected as part of the instructions when opening and funding or linking a new, Non-Qualified account with NFS.

- The eSign process for fee-based, Non-Brokerage accounts now includes the ADV package.

Read more to learn the details of each update.

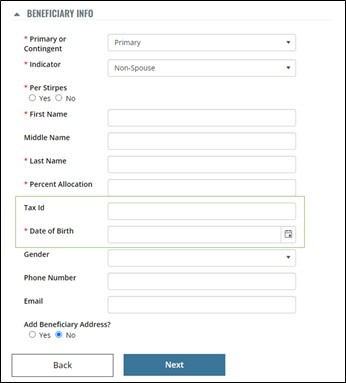

Update: Tax ID No Longer Required for Certain NFS Accounts

A Tax ID is no longer required for Person or Trust Beneficiaries on NFS Retirement and Transfer on Death accounts. NFS requires either a Date of Birth/Date of Trust (DOB/DOT) or a tax Identification number for beneficiaries. So while you don’t have to enter a Tax ID along with a Date of Birth/Date of Trust, the field will still be available if you want to enter it. This update should make opening these accounts easier because DOB/DOT is more readily available to clients when naming their beneficiaries. DOB/DOT is still a required field.

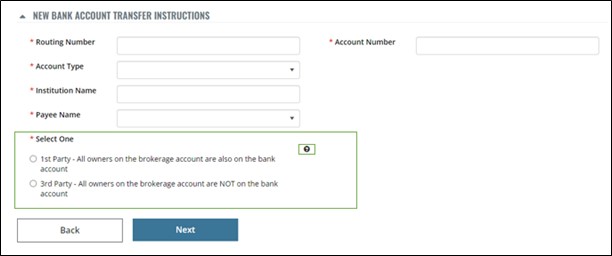

Update: NFS New Bank Account Transfer Instructions Requirement

When opening and funding or linking a new, Non-Qualified account with NFS, now you must select 1st Party or 3rd Party as part of the instructions. NFS has always required this information, but it was not part of the eQuipt account opening process. This new requirement ensures that the NFS Standing Payment Instruction Form for Non-Retirement accounts is complete, which reduces manual work and not-in-good-order (NIGO) situations.

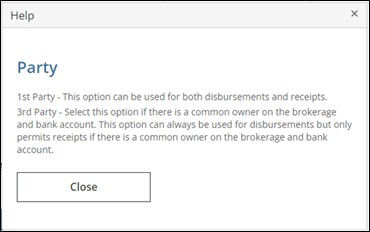

The New Bank Account Transfer Instructions questions include pop-up Help Text explaining each Party designation.

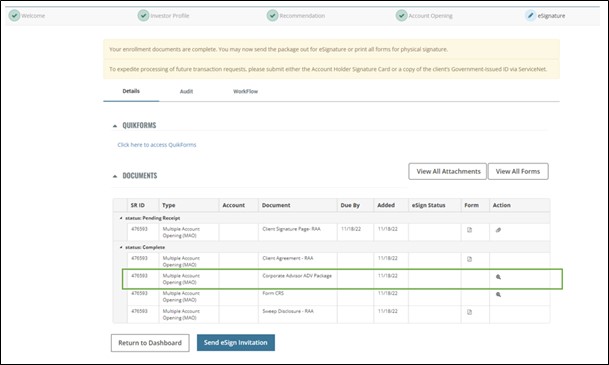

NEW! ADV Package Added to eSign Process for Fee-Based, Non-Brokerage Accounts

When opening a new, Fee-Based, Non-Brokerage account, now eQuipt includes the ADV documents for Corporate RIAs within the Document Package sent to the client via the eSignature process. This change means that the process for Corporate RIAs is more efficient because they no longer need to supply clients with the ADV documents through a different method when opening these types of accounts.

Happy Holidays!

There are only a few updates left to the eQuipt Platform for the remainder of the year. So, until next time, have a safe and wonderful holiday season.

All the best,

The eQuipt Team